Article from: NFT Evening

The user had also used their holdings to borrow $108 million in stablecoins. In the event that they might be liquidated, it could drastically bring down SOL prices.

“If SOL drops to $22.30, the whale’s account becomes liquidatable for up to 20% of their borrows (~$21M),” the proposal read. “It’d be difficult for the market to absorb such an impact since liquidators generally market sell on DEXes. In the worst case, Solend could end up with bad debt. This could cause chaos, putting a strain on the Solana network.”

Furthermore, Solend stated that they have been trying to get in touch with the whale since June 13. However, despite their efforts, they were unable to “get the whale to reduce their risk, or even get in contact with them.”

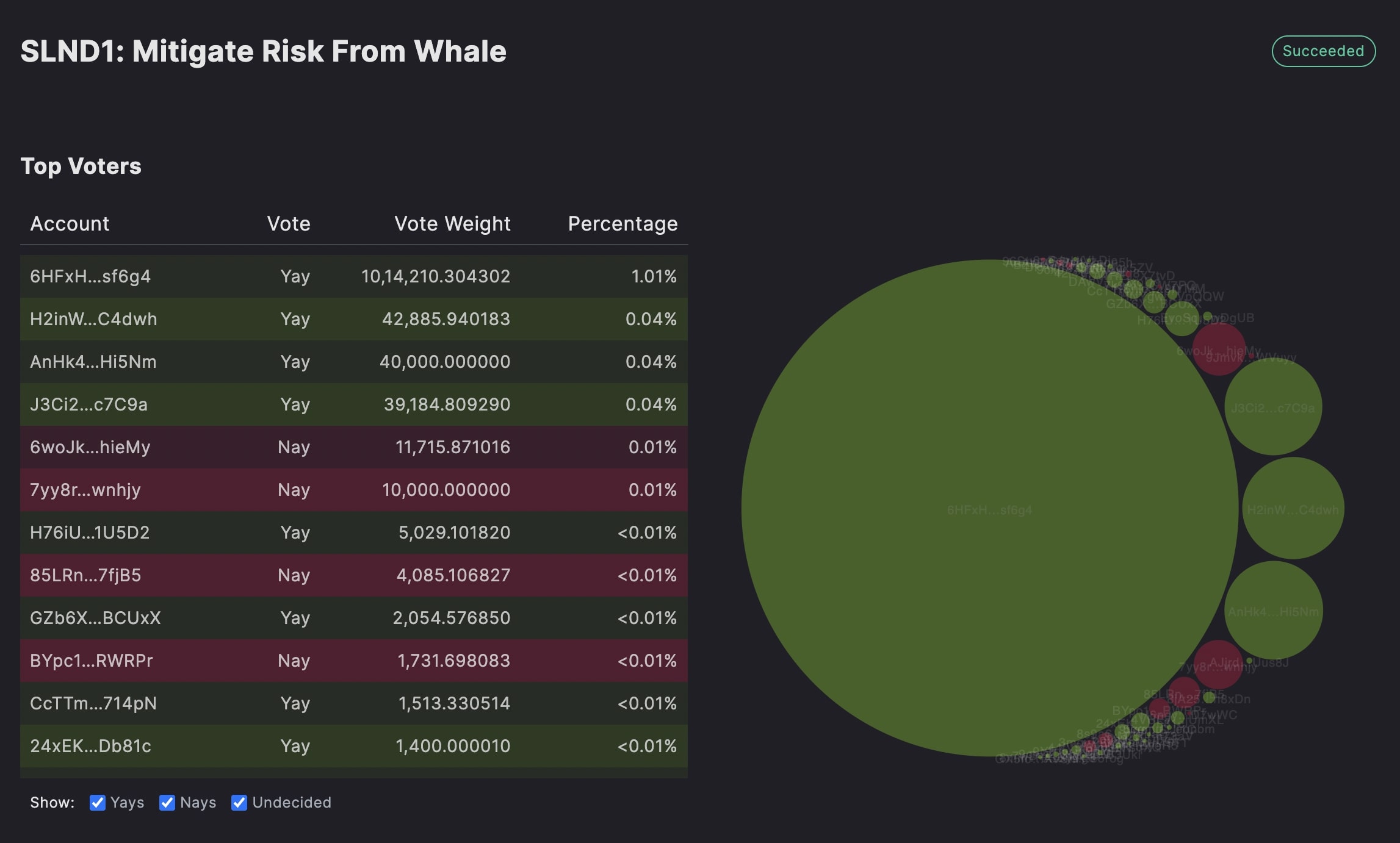

With no response from the whale, Solend was spurred to take action to “mitigate risk”. Reportedly, they set up a DAO just to hold a vote on the proposal. What’s more, allegedly, the voters only had six hours to vote, during half of which, the voting site was down. They then asked the token holders to vote yes or no for the following:

Vote Yes: Enact special margin requirements for large whales that represent over 20% of borrows and grant emergency power to Solend Labs to temporarily take over the whale’s account so the liquidation can be executed OTC.

Vote No: Do nothing.

Of the Solend token holders who voted, 97.5% voted yes. In fact, the proposal barely passed the 1% threshold, with only 1.13% voting in the affirmative. Interestingly, a single large wallet’s vote was responsible for passing the proposal.

Solend’s unprecedented move to take over a whale account has raised concerns about decentralisation in DeFi. After all, DeFi has been praised for its decentralisation capabilities, wherein financial services are provided without any intermediaries such as banks and brokerages. It is this very feature that is now raising questions.

“A whale’s account is being taken over by other people after a DAO that was spun up 24 hours ago, with a 6 hour timeframe to vote (website was down for 3 hours), voted so,” NFT influencer, Farokh commented.

Meanwhile, Loopify tweeted, “decentralization at it’s finest.”

Clearly, Solend’s action against the whale goes against the very foundation of decentralisation. The move’s wider repercussions remain to be seen.

The post Solend Takes Over Whale Account; What Does It Mean For Decentralisation? appeared first on NFT Evening.

source

Article from: NFT Evening