Digital art is a billion-dollar business, with everyone from Paris Hilton to Damien Hirst trading in ‘non-fungible tokens’. But are NFTs just a get-rich-quick scheme masquerading as culture?

“It’s actually a lot simpler than you think.” It’s a Tuesday afternoon, and somewhat to my surprise, I’m on the phone to Paris Hilton, who is graciously explaining the world of NFTs.

Hilton is many things – a reality star, an heiress, an unlikely lockdown fitness guru who uses designer handbags instead of weights. But until now, she has never been considered a significant player in the art world. When artists have acknowledged her, often they’ve done so to fetishise her image. In 2008, Damien Hirst bought a portrait of her by the artist Jonathan Yeo, in which her body is constructed from collaged images cut from porn magazines.

Yet in the past year she’s become a surreal figurehead in the NFT scene: a world flush with crypto dollars and high on a promise to transform the worlds of art and commerce. When we speak, Hilton has just returned from a bitcoin conference in Miami, where customers paid up to $25,000 for VIP tables at the opening party to watch her DJ in a pair of diamanté-encrusted headphones. “NFT stands for non-fungible token, a digital token that is redeemable for a digital piece of art,” she explains. “You can have it on your computer server or your phone. I have these screens in my house where I display them.”

Sure enough, at Hilton’s Beverly Hills mansion there are screens displaying NFTs she made in collaboration with the digital artist Blake Kathryn. These include a video of a chihuahua on top of a rotating ionic column (a tribute to her deceased pet Tinkerbell) and an animated self-portrait of Hilton as a sparkling CGI Barbie floating in the clouds, a piece she’s called Iconic Crypto Queen, and which she sold in April for more than $1m.

Hilton first started investing in cryptocurrency in 2016. “I became friends with the founders of Ethereum,” she says. (Ethereum produces ether, the currency in which the majority of NFTs are traded.) Since then she’s thrown herself into collecting crypto art, and owns more than 150 NFTs.

To advocates of the NFT, the technology offers a revolutionary new way of selling art, and of circumventing snooty cultural gatekeepers whose resistance to a crypto future seems as square as the 19th-century Parisian art world’s disdain for impressionism. In this context, the relevance of Hilton’s brand to the NFT movement makes sense. Pink, jewel-encrusted, and openly motivated by being as rich and famous as humanly possible, she’s a far cry from the type of person whose work is typically exhibited in blue-chip galleries or hung in booths at art fairs.

Yet Hilton’s endorsement may also be ammunition for those who view the NFT as just another depressing example of the speculative logic of finance monopolising taste. To detractors, from critic Waldemar Januszczak to artist David Hockney, the NFT marketplace is a home for morally bankrupt, environmentally vandalistic money-grabbers whose creations barely qualify as art.

While most of us are still trying to remember what “fungible” means, a battle is under way to define how NFTs are understood. Are they a vital cultural product that tells us something profound about digital consumerism? Or are they just the latest cynical way to make absurd amounts of money?

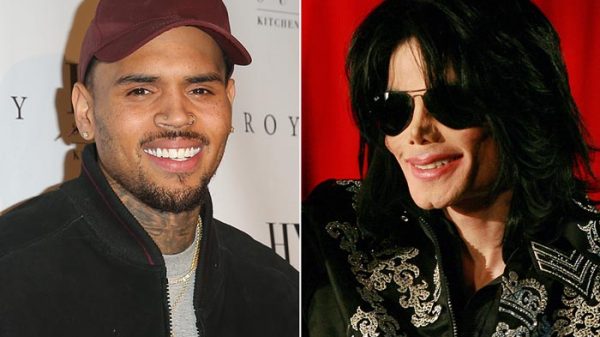

A motley crew of celebrities have tried their hand at selling digital art, including Snoop Dogg, Lindsay Lohan and John Cleese. In July, it was estimated that sales of NFTs in the first half of 2021 rose by more than $2bn (£1.47bn) – a trend that prompted Christie’s and Sotheby’s to host their own NFT auctions and that is credited with driving contemporary art sales to an all-time high. But only a tiny proportion of the proceeds of art NFTs have ended up in the bank accounts of the galleries that have, in addition to auction houses, traditionally taken the lion’s share of art-market profits.

In March, the crypto firm Injective Protocol paid $95,000 for Morons, a physical artwork by Banksy depicting an auctioneer selling a framed picture bearing the words: “I can’t believe you morons actually buy this shit.” They then burned the picture before selling a digital token of the work for $380,000. The event was a marketing ploy, designed to stoke outrage, drum up publicity and turn a profit. Yet the symbolism was potent: digital art is here to replace its physical forebear, and its coming supremacy should be reflected by a higher price tag.

In essence, an NFT is a digital certificate of ownership, almost always bought and sold using cryptocurrency, to which any digital file – a jpeg image file, a video, a song – can be attached. That Hilton is able to display Iconic Crypto Queen in her home, despite having sold it, is part of the NFT’s appeal – and the challenge it poses to the established business model for trading and accessing art. With a simple Google search, anybody can find and download the file associated with an NFT for nothing, and store it on their phone or computer, but only the owner has the right to sell it. Each NFT is unique, and all transactions are logged on the blockchain, a type of database invented in 2008 for the purpose of recording the movement of cryptocurrency.

Unlike the commercial gallery business model, NFTs are designed to cut out the need for art dealers, enabling artists to trade directly online, typically via specialist auction sites. Crucially, in contrast to the contemporary art world, there is no “vetting” of collectors – a practice intended to stop the most speculative buyers flipping artworks by quickly reselling them at a profit. Anybody can buy an NFT, and prices, so often a thing of mystery in high-end commercial galleries, are listed as a matter of public record. Every time an NFT is resold, its creator also makes a profit – an inbuilt royalty system missing from the physical art world, where artists often feel as if they have been shafted when their work is resold on the secondary market.

A model for trading and sharing art, built on the principles of financial transparency, royalties and easy access for all may sound egalitarian. The reality has been rather different. As soon as it became apparent that almost anything digital could be labelled as art and sold, the circus rolled into town.

In March, Everydays: The First 5000 Days, a collage of previous artworks by a 40-year-old American named Mike Winkelmann, better known as Beeple, sold for $69.3m at Christie’s New York. After that, Kate Moss sold a gif of herself for more than $17,000. Jack Dorsey, CEO of Twitter, sold an image of the first ever tweet for $2.9m. A Brooklyn film director managed to sell an audio file of his own farts for $85. Dominic Cummings even threatened to use the technology against Boris Johnson, by releasing what he said was evidence of government malpractice in the form of an NFT.

Along the way, the market became gratuitously inflated. Bidders at the top end included Vignesh Sundaresan, a blockchain entrepreneur who bought Beeple’s $69m NFT. A considerable number of small-time enthusiasts were also buying at the affordable end of the market, keen to celebrate the technology by investing in blockchain art. It didn’t take long before the bubble burst. By May, daily sales of NFTs had dropped by 60%. Crypto art’s reputation has also taken a knock because of its awful environmental track record. (The annual energy consumption of Ethereum is estimated to equal that of Iceland.)

Despite this, advocates still believe NFTs can mount a challenge to the monopoly on trading art held by commercial galleries, and even create a future where physical artworks are replaced by their digital counterparts. As Hilton puts it: “There are paintings out there that are $100m or more, but if you think about it, it’s really just canvas with paint.”

In the beginning, before the circus pitched up, there were nerds. Inevitably, because this is the internet, there were also cats. CryptoKitties, to be precise, is an online game launched in 2017, enabling players to trade and “breed” unique cartoon felines, sold as NFTs, using blockchain technology. Although the first NFT was created by a man named Kevin McCoy in 2014, CryptoKitties attracted attention and money, with some cats trading for hundreds of thousands of dollars. During 2020, as cryptocurrencies boomed and the pandemic accelerated our transformation into a species of screen-obsessed zombies, interest in NFTs rapidly picked up pace. As a consequence, the value of work by a relatively small number of artists already on the scene rocketed.

Among them was Trevor Jones, a 51-year-old painter who lives in Edinburgh. You’ve probably never heard of Jones, but he’s the most successful NFT artist working in the UK. He started making NFTs in 2019. “Five years ago, I was struggling to pay the mortgage,” he tells me. “I went from having to borrow money from friends to pay the bills to making $4m in a day.”

Jones has made a name for himself combining painting with digital technology, often producing pastiches of famous artworks with a crypto twist. In 2020, Bitcoin Bull – an animated painting of a Picasso-inspired bull, decorated with bitcoin logos and Twitter birds – was bought by a prominent crypto collector named Pablo Rodriguez-Fraile for $55,555.55.

Jones is warm, unguarded, and stunned by his rapid ascent. “I grew up in a little logging community,” he says of his childhood in western Canada, a place he describes as “rough”. “When I was 25, a friend of mine ended up getting into a fight at a bar and was killed.” He left soon after, eventually settling in Edinburgh, where he worked at the city’s Hard Rock Cafe as a waiter and later as a manager.

Jones tells me about the mental health crisis he suffered in his early 30s. “My girlfriend and I broke up and it kind of all came crashing down. At that point, it sounds cliched, but I decided I needed to find something to save me.”

He set his heart on becoming an artist and “begged” his way on to an art foundation course at Leith School of Art, which he followed with a degree at the University of Edinburgh.

Things began to look up for Jones in 2012, when he had the idea of incorporating QR codes into his art, painting the scannable barcodes in Mondrian-like colours on canvas. Scanning the paintings takes viewers through to an online gallery, where anybody can upload their work. “People were laughing at me at the time,” he says. While gallery audiences turned their noses up, he gained a new following online, one that would turn out to have deep pockets.

In 2019, Jones began working with animators to turn his paintings into short videos that he sold as NFTs. Among his most successful works is Bitcoin Angel, an NFT based on Bernini’s baroque masterpiece The Ecstasy of Saint Teresa, which he sold in 2020 for the equivalent of more than $3m (all of Jones’s NFTs are bought using cryptocurrency). In Bernini’s marble sculpture, a nun has been stabbed in the heart by an angel with a spear. She leans backwards, overcome by the sublime ecstasy of being penetrated by a heavenly body. When the arrow pierces the heart of Jones’s nun, she bleeds bitcoin.

To sell Bitcoin Angel, Jones used a website called Nifty Gateway, one of a number of online auction sites designed for trading NFTs that are now flooded with aspiring crypto artists. I dedicated an afternoon to scrolling through the lots, each one flashing and jiggling in the hope of attracting the attention of collectors. I saw gifs of muffins transforming into dogs, spinning trainers, sycophantic portraits of Elon Musk and an abundance of naked, big-boobed cyborgs. The art critic Dean Kissick described the male-dominated NFT scene as “Etsy for guys”, and on this evidence it’s easy to see why. Aside from the headline-grabbing sales, Nifty Gateway provides a platform for aspirational entrepreneurs and hobbyists, who practise their craft on computers rather than knotting macrame plant hangers.

While those – like Jones – who successfully rode the NFT wave were busy counting their crypto dollars, over the past year the conventional art world has suffered a decline. During the pandemic, with audiences unable to physically attend exhibitions and fairs, art dealers have struggled to make online viewing rooms interesting or lucrative. As a consequence, global sales of art fell by 22%. To rub salt in that wound, millions of crypto dollars were exchanging hands for a natively digital art form. “The technology is designed against the existing art world,” says Noah Davis, a specialist at Christie’s New York. “It’s an art form that doesn’t need a gallery.”

It was Davis who helped to sell Beeple’s $69m NFT, the first piece of crypto art ever listed by a major auction house. He views his own impact as pivotal: “I introduced NFTs to the Christie’s audience and thereby the world,” he says. The artwork was sold during an online auction in March that took two weeks to close. Bidding opened at $100, and within an hour that figure had risen to $1m – the result of a vast number of bids all happening digitally. “I’ve never seen anything so spectacular. You can’t bid that quickly at auction unless you just shout out: ‘A million bucks,’” Davis says, “and that’s impossible to do online. So all that bidding had to happen in increments and manually.

“I look at my life as pre-Beeple and post-Beeple,” he adds. “The same way the world thinks about before Jesus Christ and after. Beeple is kind of my Jesus.”

In the months since, Christie’s has continued to cash in on NFTs. In May, it achieved $16.9m for nine pixellated cartoon characters from the CryptoPunks series, early examples of NFT art that have become sought-after collectibles. Christie’s has also attempted to unite the crypto and modern art markets. This spring, it hosted a sale of digital artworks made by Andy Warhol in the 1980s. The images, which had been recovered from floppy disks and transformed into NFTs, include drawings, made on the artist’s Commodore Amiga computer, of bananas, flowers, and of a Campbell’s soup can that alone sold for more than $1m.

In general, the commercial gallery world has been understandably cagey about adopting technology designed to circumvent it. Behind the scenes, however, a number of galleries have attempted to woo Jones. He has declined their advances. “What can a commercial gallery do for me?” he asks. “Having a gallery exhibition before, I worked a year creating paintings, I paid for all the framing, the overheads for the studio. I had the paintings delivered to the commercial gallery. I may or may not sell, the gallery takes 45 to 55% commission, and they might pay out a month, six weeks, two months later.” And now? “I sell something and three minutes later I’ve got the money in my digital wallet.”

At times, the divide between the two art worlds seems more profound than a difference in business model: it’s an all-out culture clash. “Few of these cyber-millionaires could tell the back of a Rembrandt from the front,” wrote art critic Waldemar Januszczak. “There is no challenge whatsoever in NFT art,” conceptual art collector Pedro Barbosa told the New York Times, arguing that the ideas behind NFTs are often derivative, having “already been explored by artists like Josef Albers, László Moholy-Nagy, and Marcel Duchamp”. David Hockney branded NFTs “silly little things” for “crooks and swindlers” – a curious accusation from an artist happy to embrace and monetise novel digital technology. Since 2009, Hockney has been doing a roaring trade in souped-up iPhone and iPad drawings.

Jones tells me that the crypto faithful, who, like Hilton, ardently believe that NFTs are the future of art, now use the dusty epithet “the legacy art world” to refer to their physical rivals.

As a painter, Jones is unusual among NFT artists. On occasion, this has allowed him the opportunity to sell the original painting on which an NFT is based, as well as the NFT. Pulling off this kind of double sale, however, must be handled carefully. Charging more for a painting than an NFT, and thus valuing physical art more highly than digital art, could provoke the ire of the crypto crowd. When Jones sold Bitcoin Bull to Rodriguez-Fraile, he also sold the original painting to the second-place bidder. In order not to offend his fans, he priced the painting at $55,000 – $555.55 less than the NFT.

A handful of established contemporary artists, notably those who have form when it comes to explicitly courting headlines and extreme wealth, have tried their hand at making NFTs – most prominently Damien Hirst, who released the project The Currency in July. Hirst put 10,000 NFTs up for sale, each corresponding to a unique spot painting, for $2,000 a piece. But there is a catch: after two months, the collector must decide if they wish to keep the NFT or the physical art work. Whichever one they don’t choose will be destroyed, forcing the owner to gamble on which version will be more valuable in the future.

The most shocking aspect of the NFT to the art intelligentsia is its brazen entanglement with finance. Trading art has always been a pastime of the wealthy. Much of what counts for art history consists of flattering portrayals of the rich and powerful, and artists have long been expected to perform what Tom Wolfe called the Art Mating Ritual – attracting the interest of wealthy patrons and conservative institutions, while simultaneously presenting as Bohemians and renegades. Yet with the NFT, the distinction between art and asset seems to have disappeared. In place of the curated exhibition is the auction website; symbols of the market have seeped into the aesthetic language of the art itself. Prices, not ideas, dominate.

Despite the promise of “art for everyone”, the final destination of the NFT might not actually be art. Art may simply be a useful way to advertise the possibilities of a new technology. “I’ve done everything from fashion, fragrances to endorsements,” Paris Hilton says, adding that NFTs are another way for “fans to have a piece of me”. As well as working with the rapper Ice Cube, Jones recently made an NFT for the whisky company Macallan, to be auctioned alongside a very expensive cask of scotch. This, it seems, is a taste of where NFTs may be heading: not a radical new model for trading art, but a digital marketing bauble.

Perhaps the most significant legacy of the NFT’s assault on the art market will be the questions it forces us to ask about the nature of art, and what it is that we want from it. How should art be traded and viewed? Who gets to ascribe value to art? Is there a moral or aesthetic code by which artists are expected to work, and who has elected themselves to define it? And why would anybody part with their money in exchange for a digital fart? Then there’s the biggest question: is there a meaningful difference between an artwork and an asset? The answer, perhaps, is not always – but if we want art to be more than a tool for prettifying finance and flogging merch, then it’s an ideal worth holding on to.

Rosanna McLaughlin is editor of The White Review