Article from: News BTC

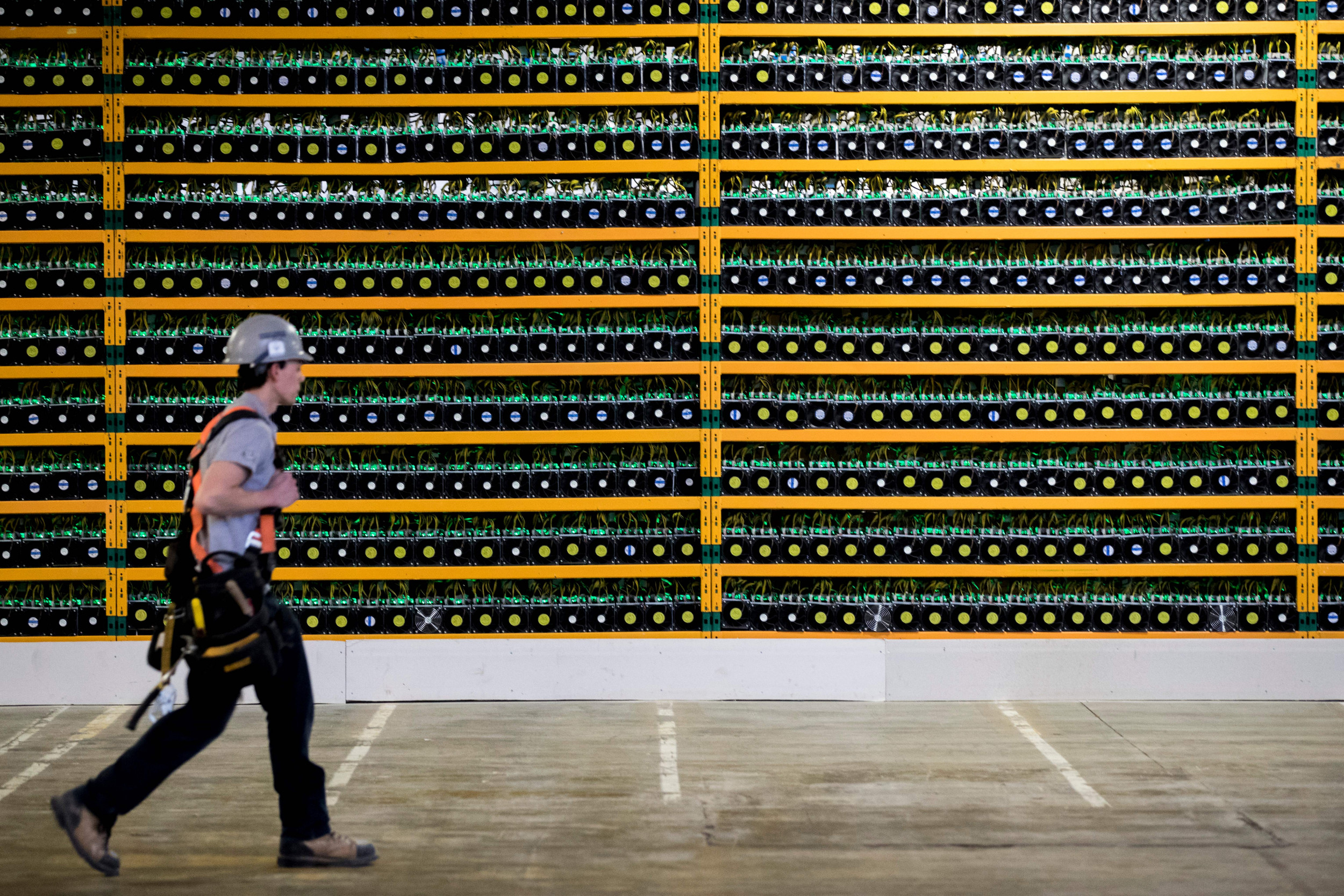

Bitcoin mining profitability has been dropping along with the market decline. The cash flow from the mining rigs has become increasingly stunted over time, causing bitcoin miners to begin selling their holdings to cover the cost of their operations. But even as this rages on, there is a bigger issue that could threaten the recovery that BTC has made so far, which is the fact that larger miners may be forced to liquidate their holdings.

Usually, bitcoin miners are known for holding the coins that they realize from their activities. Since miners are not buying the coins in the first place, it makes them the natural net sellers of bitcoin. However, their tendency to hold these coins has often seen them having to offload their bags onto suffering markets. So instead of actually selling in a bull, they tend to hold until the bull market is over and with profitability down in a bear market, are forced to sell coins to finance their operations.

Related Reading | Bitcoin Recovery Wades Off Celsius Liquidation, But For How Long?

The same is the scenario that is currently playing out in the market. With bitcoin more than 70% down from its all-time high value, miners are nowhere close to as profitable as they were back in November 2021. In the first four months of 2022, it is reported that public mining companies have had to offload about 30% of their BTC gotta from mining. This meant that the miners were having to sell more BTC than they were producing in the month of May.

Given that the market in May was significantly better than in June, it is expected that the miners would have to ramp up selling. This would likely see miners selling all of their BTC production for the month alongside the BTC that they already held prior to 2022.

It is important to note that bitcoin miners are some of the largest bitcoin whales in the space. This means that their holdings have the potential of being a major market mover when dumped at the same time. These miners hold as large as 800,000 BTC collectively with public miners accounting for just 46,000 BTC of that number.

What this means is that if bitcoin miners are pushed to the wall where it triggers a mass sell-off, the price of the digital asset would have a hard time holding up against it. The massive sell-side pressure it would create would push the price further down, likely being the event that would see it touch its eventual bottom.

The behaviors of the public miners can often help point to if a massive sell-off is imminent. These public companies only account for about 20% of all bitcoin mining hashrate but if they are forced to sell, then it is likely that private miners are being forced to sell.

Related Reading | Gold Proves To Be A Safe Haven Asset Amid Bitcoin Crash

Short-term recovery on the part of bitcoin can push back this sell-off. However, it will only be a short-lived reprieve as energy costs are constant and some machines, namely the Antminer S9, have now become cash-flow negative. To survive the bear market, miners would simply have no choice but to dump some BTC to weather the storm.

Follow Best Owie on Twitter for market insights, updates, and the occasional funny tweet…

source

Article from: News BTC